When a plan is self-insured unless the assets are held in a trust* (e.g. VEBA), there usually is no Schedule A nor Schedule C included for the self-insured plan in a Form 5500 filing.

Schedule A is used to report “insurance contracts information” so by definition, a self-insured policy is not an “insurance contract”. They are self-insured benefits from the employer to the employee group and not reportable on a Sch A. Per the Form 5500 instructions:

“Schedule A (Form 5500) must be attached to the Form 5500……if any benefits under the plan are provided by an insurance company, insurance service, or other similar organization (such as Blue Cross, Blue Shield, or a health maintenance organization)”

An ASO carrier may provide Schedule A information automatically to an employer leading to confusion. Some carriers do this proactively in the event the employer is required to file a Schedule A for the stop-loss coverage. However, stop-loss insurance is fully insured benefits on the employer (vs employees) and typically not reportable unless the fund assets are held in a trust*.

Schedule C is used to provide information about service providers’ compensation & fees. However, there are rules exempting plans that satisfy Technical Release 92-01 and also welfare plans that satisfy DOL regulation § 2520.104-44 from having to complete and file a Sch C. Which in a nutshell means, self-insured plans that pay claims through the company’s general assets and take employee contributions pre-tax usually do not have a Schedule C requirement. It is only for “service providers” of plans funded via a trust*.

How Are Self-Insured Plans Reported?

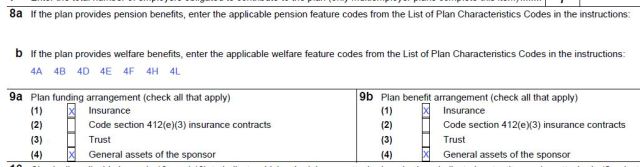

The self-insured benefits on the employee’s, are included in the 5500 by virtue of a benefit code on line 8B (e.g. 4A=health coverage) of the Form 5500 and by checking general assets on line 9A/9B. (General assets would not be checked if all plans were fully insured.)

It is most common for a self-insured plan to pay claims from the employer’s general assets and take employee contributions via a cafeteria plan pretax, therefore no Schedule A nor C would be included for those self-insured plans in a Form 5500 filing.

*NOTE: The general rule is a Form 5500 is required for a plan with 100+ participants as of the first day of the plan year. There is an exception to this rule. A plan that is funded through a trust, is considered “funded” (the money is set aside for payment of claims) and therefore also would be required to file a form 5500 even if less than 100 participants.